IIPM, ADMISSIONS FOR NEW DELHI & GURGAON BRANCHES

How lefty-friendly is the right handed world?

As

a child when consciousness had little to do with me and even smaller was my awareness of directions, I distinctly (but perhaps not fondly) remember all the strait-laced grown-ups in the vicinity tapping on my hand every time, I would naturally lift it to eat or write. Later, on growing up, it dawned upon me that it wasn’t lack of etiquettes or absurdity of my acts that prompted those slight slaps but my dear left hand, programmed by nature itself as my first!

a child when consciousness had little to do with me and even smaller was my awareness of directions, I distinctly (but perhaps not fondly) remember all the strait-laced grown-ups in the vicinity tapping on my hand every time, I would naturally lift it to eat or write. Later, on growing up, it dawned upon me that it wasn’t lack of etiquettes or absurdity of my acts that prompted those slight slaps but my dear left hand, programmed by nature itself as my first!While this was then, the world now seems to have grown up to acknowledge our presence and even celebrate 13th August as the World Left-Handers’ Day. The day sets sights on apprising the ignorant right-handed world (which bullies the left - handers as squiffy or Keggy-handed on several occasions) that left-handers are not gawky and graceless for their innate abilities, but the forceful usage of chockfull right-handed gadgets which is in reverse for them. A common instance concerning this that races back and forth in the mind is the underground station where the automated ticket machine on one’s right leads a left -hander to either cross his hand to dump the ticket in the slot or put it in the wrong slot causing the adjacent gate to open!

Though

the furniture in institutions hasn’t been any customised either, the compliments, then on ingenuity are quite common to several left-handers. The saying ‘only left-handers are in their right minds’ is true to its nature scientifically too. The right side of the brain controlling the left side of the body is dominant in holistic thinking making the left–handers exceptional at creativity, music, art, emotions and imagination. Undoubtedly, Leonardo da Vinci, Mark Twain, David Byrne, Paul McCartney, Amitabh Bachchan, Charlie Chaplin, Sarah Jessica Parker, Nicole Kidman and Oprah Winfrey are all left -handed champions in their respective creative arenas. Fast at spatial intelligence, yet faster at using both sides of the brain in complicated situations, left-handers face their share of hazards too. Reaching puberty four to five months later than their right-handed counterparts isn’t as heart sinking as the recent study that concludes that their average life span is lesser than right-handers too. Speech defects though common among left-handers can aggravate to stuttering and stammering if forced to convert into a right-hander. An unfortunate example was King George VI.

the furniture in institutions hasn’t been any customised either, the compliments, then on ingenuity are quite common to several left-handers. The saying ‘only left-handers are in their right minds’ is true to its nature scientifically too. The right side of the brain controlling the left side of the body is dominant in holistic thinking making the left–handers exceptional at creativity, music, art, emotions and imagination. Undoubtedly, Leonardo da Vinci, Mark Twain, David Byrne, Paul McCartney, Amitabh Bachchan, Charlie Chaplin, Sarah Jessica Parker, Nicole Kidman and Oprah Winfrey are all left -handed champions in their respective creative arenas. Fast at spatial intelligence, yet faster at using both sides of the brain in complicated situations, left-handers face their share of hazards too. Reaching puberty four to five months later than their right-handed counterparts isn’t as heart sinking as the recent study that concludes that their average life span is lesser than right-handers too. Speech defects though common among left-handers can aggravate to stuttering and stammering if forced to convert into a right-hander. An unfortunate example was King George VI.It’s gladdening that I didn’t give in to the forceful elderly to become like the stammering, tear prone king if not the least like the mirror writing prone Michelangelo and Lewis Carroll.

Edit bureau: Swati Hora (a proud leftist)

For Complete IIPM Article, Click on IIPM Article

Source : IIPM Editorial, 2007

An IIPM and Professor Arindam Chaudhuri (Renowned Management Guru and Economist) Initiative

For More IIPM Info, Visit Below....

The Sunday Indian - India's Greatest News weekly

IIPM Mumbai Parables - Stories that change life

IIPM International Student Exchange Programme

IIPM, GURGAON

ARINDAM CHAUDHURI’S 4 REASONS WHY YOU SHOULD CHOOSE IIPM...

IIPM Economy Review

IIPM :- Cicero's Challenge is going global

The Indian Institute of Planning and Management (I...

Time for Awards at IIPM

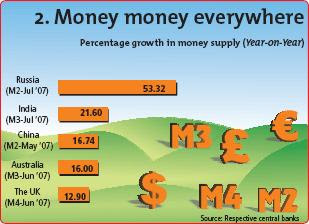

aren’t the central bankers trying to bailout the banks? Well, a crunch in the interbank market means a slump in the world-wide banking system, which will bring the entire world economy to a grinding halt and central bankers would certainly not want that to happen. As Bryson puts it, “The central banks here are treading a fine line by not trying to bail out institutions, while at the same time they do not want a severe credit crunch, which will put a drag on the growth of the global economy.”

aren’t the central bankers trying to bailout the banks? Well, a crunch in the interbank market means a slump in the world-wide banking system, which will bring the entire world economy to a grinding halt and central bankers would certainly not want that to happen. As Bryson puts it, “The central banks here are treading a fine line by not trying to bail out institutions, while at the same time they do not want a severe credit crunch, which will put a drag on the growth of the global economy.”