The Sunday Indian - India's Greatest News weekly

In an act of brilliance, our central bankers keep us afloat...

It was a crisis of a lifetime for our central bankers and… Christ didn’t they act infallibly right! In a world swamped by liquidity with ever looming danger of inflation…Christ didn’t they act infallibly right! Their intervention went down as the largest liquidity injection that mankind has ever witnessed, wherein funds worth hundreds of billions of dollars were pumped in to restore liquidity in the markets. For many, the recent liquidity crisis in the inter-bank market and how the central bankers handled it might seem like a bailout of epic proportions; but the truth begs to differ from this.

was a crisis of a lifetime for our central bankers and… Christ didn’t they act infallibly right! In a world swamped by liquidity with ever looming danger of inflation…Christ didn’t they act infallibly right! Their intervention went down as the largest liquidity injection that mankind has ever witnessed, wherein funds worth hundreds of billions of dollars were pumped in to restore liquidity in the markets. For many, the recent liquidity crisis in the inter-bank market and how the central bankers handled it might seem like a bailout of epic proportions; but the truth begs to differ from this.

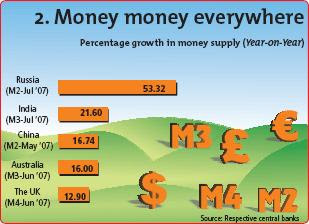

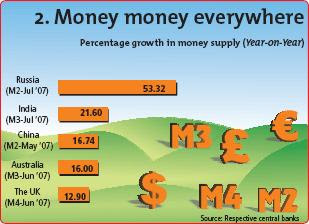

What happened in the past fortnight saw banks refraining from lending to each other, which led to a liquidity crisis. Substantiating the liquidity crunch, the London Inter bank Offered Rates (LIBOR) for dollar went through the roof from 5.37% as on to August 01, 2007 to 5.95% as on August 10, 2007 (See chart 1). Banks have been locked up with risky and illiquid assets, which are exposed to subprime lending and with a slump in the housing sector, these banks are not ready to lend to each other, considering the counterparty risk arising out of these risky exposures. This is where the central banks have stepped in to reliquify the markets by lending money to the banks in the interbank market. But then, is it liquidity that the world needs at this point of time, considering the fact that for the past few years, there has been an unprecedented amount of liquidity sloshing the global markets, fuelling alarming assets bubbles (chart 2)? Jay Bryson, Global Economist, Wachovia, explains to B&E, “Over the past few days, there has been a liquidity crisis with banks unwilling to lend each other in the interbank & the infusions made by the central banks will reliquify the markets.” So definitely it has been a matter of losing trust.

But aren’t the central bankers trying to bailout the banks? Well, a crunch in the interbank market means a slump in the world-wide banking system, which will bring the entire world economy to a grinding halt and central bankers would certainly not want that to happen. As Bryson puts it, “The central banks here are treading a fine line by not trying to bail out institutions, while at the same time they do not want a severe credit crunch, which will put a drag on the growth of the global economy.”

aren’t the central bankers trying to bailout the banks? Well, a crunch in the interbank market means a slump in the world-wide banking system, which will bring the entire world economy to a grinding halt and central bankers would certainly not want that to happen. As Bryson puts it, “The central banks here are treading a fine line by not trying to bail out institutions, while at the same time they do not want a severe credit crunch, which will put a drag on the growth of the global economy.”

Again, won’t this liquidity injection be inflationary? Considering the fact that inflation targeting has been the mandate of central bankers, this liquidity injection doesn’t go down the throats of many easily. Normally, an injection of such proportion carries the seeds of inflation with itself. But then, here’s where the central bankers have acted smartly. All the liquidity that has been injected into the system has been through Repurchase Agreements (Repos) and by definition, central banks will repurchase what they have lent to the banks in the interbank market. So, the liquidity injection has been in terms of overnight lending which will be sucked back. As Craig Alexander, VP & Deputy Chief Economist, TD Bank Financial Group, clarifies to B&E, “There are no rate cuts as we saw in 2001, so the liquidity expansion hasn’t been as broad based. Moreover, liquidity being injected is through overnight transactions, so the money does not remain in the system and it won’t be inflationary.” He further argues that if the credit problems persist, the central banks will cut rates, but this would hardly prove inflationary, since it will be in response to concerns of economic weakness. But then, what’s with equity markets, when everything’s been so prudent. Well, first of all, the sell off has been to an extent marked by banks reversing their equity positions in search of liquidity. Secondly, there has been a psychological impact on investors as Craig Alexander elaborates, “The immediate reaction by markets was negative, as they worried that the central banks actions signalled that there was a major problem. However, markets will eventually realise that the additional liquidity is extremely positive & supportive to the financial system.”

clarifies to B&E, “There are no rate cuts as we saw in 2001, so the liquidity expansion hasn’t been as broad based. Moreover, liquidity being injected is through overnight transactions, so the money does not remain in the system and it won’t be inflationary.” He further argues that if the credit problems persist, the central banks will cut rates, but this would hardly prove inflationary, since it will be in response to concerns of economic weakness. But then, what’s with equity markets, when everything’s been so prudent. Well, first of all, the sell off has been to an extent marked by banks reversing their equity positions in search of liquidity. Secondly, there has been a psychological impact on investors as Craig Alexander elaborates, “The immediate reaction by markets was negative, as they worried that the central banks actions signalled that there was a major problem. However, markets will eventually realise that the additional liquidity is extremely positive & supportive to the financial system.”

Well, take a look around and one can see the markets are hitting back to normal and the trust seems to be back amongst the market participants. Well, a crisis of such debilitating proportion needed an divine intervention and… Christ they did act infallibly right!!!

For Complete IIPM Article, Click on IIPM Article

Source : IIPM Editorial, 2007

An IIPM and Professor Arindam Chaudhuri (Renowned Management Guru and Economist) Initiative

For More IIPM Info, Visit Below....

IIPM Mumbai Parables - Stories that change life

IIPM International Student Exchange Programme

IIPM, ADMISSIONS FOR NEW DELHI & GURGAON BRANCHES

IIPM, GURGAON

ARINDAM CHAUDHURI’S 4 REASONS WHY YOU SHOULD CHOOSE IIPM...

IIPM Economy Review

IIPM :- Cicero's Challenge is going global

The Indian Institute of Planning and Management (I...

Time for Awards at IIPM

In an act of brilliance, our central bankers keep us afloat...

It

was a crisis of a lifetime for our central bankers and… Christ didn’t they act infallibly right! In a world swamped by liquidity with ever looming danger of inflation…Christ didn’t they act infallibly right! Their intervention went down as the largest liquidity injection that mankind has ever witnessed, wherein funds worth hundreds of billions of dollars were pumped in to restore liquidity in the markets. For many, the recent liquidity crisis in the inter-bank market and how the central bankers handled it might seem like a bailout of epic proportions; but the truth begs to differ from this.

was a crisis of a lifetime for our central bankers and… Christ didn’t they act infallibly right! In a world swamped by liquidity with ever looming danger of inflation…Christ didn’t they act infallibly right! Their intervention went down as the largest liquidity injection that mankind has ever witnessed, wherein funds worth hundreds of billions of dollars were pumped in to restore liquidity in the markets. For many, the recent liquidity crisis in the inter-bank market and how the central bankers handled it might seem like a bailout of epic proportions; but the truth begs to differ from this.What happened in the past fortnight saw banks refraining from lending to each other, which led to a liquidity crisis. Substantiating the liquidity crunch, the London Inter bank Offered Rates (LIBOR) for dollar went through the roof from 5.37% as on to August 01, 2007 to 5.95% as on August 10, 2007 (See chart 1). Banks have been locked up with risky and illiquid assets, which are exposed to subprime lending and with a slump in the housing sector, these banks are not ready to lend to each other, considering the counterparty risk arising out of these risky exposures. This is where the central banks have stepped in to reliquify the markets by lending money to the banks in the interbank market. But then, is it liquidity that the world needs at this point of time, considering the fact that for the past few years, there has been an unprecedented amount of liquidity sloshing the global markets, fuelling alarming assets bubbles (chart 2)? Jay Bryson, Global Economist, Wachovia, explains to B&E, “Over the past few days, there has been a liquidity crisis with banks unwilling to lend each other in the interbank & the infusions made by the central banks will reliquify the markets.” So definitely it has been a matter of losing trust.

But

aren’t the central bankers trying to bailout the banks? Well, a crunch in the interbank market means a slump in the world-wide banking system, which will bring the entire world economy to a grinding halt and central bankers would certainly not want that to happen. As Bryson puts it, “The central banks here are treading a fine line by not trying to bail out institutions, while at the same time they do not want a severe credit crunch, which will put a drag on the growth of the global economy.”

aren’t the central bankers trying to bailout the banks? Well, a crunch in the interbank market means a slump in the world-wide banking system, which will bring the entire world economy to a grinding halt and central bankers would certainly not want that to happen. As Bryson puts it, “The central banks here are treading a fine line by not trying to bail out institutions, while at the same time they do not want a severe credit crunch, which will put a drag on the growth of the global economy.”Again, won’t this liquidity injection be inflationary? Considering the fact that inflation targeting has been the mandate of central bankers, this liquidity injection doesn’t go down the throats of many easily. Normally, an injection of such proportion carries the seeds of inflation with itself. But then, here’s where the central bankers have acted smartly. All the liquidity that has been injected into the system has been through Repurchase Agreements (Repos) and by definition, central banks will repurchase what they have lent to the banks in the interbank market. So, the liquidity injection has been in terms of overnight lending which will be sucked back. As Craig Alexander, VP & Deputy Chief Economist, TD Bank Financial Group,

clarifies to B&E, “There are no rate cuts as we saw in 2001, so the liquidity expansion hasn’t been as broad based. Moreover, liquidity being injected is through overnight transactions, so the money does not remain in the system and it won’t be inflationary.” He further argues that if the credit problems persist, the central banks will cut rates, but this would hardly prove inflationary, since it will be in response to concerns of economic weakness. But then, what’s with equity markets, when everything’s been so prudent. Well, first of all, the sell off has been to an extent marked by banks reversing their equity positions in search of liquidity. Secondly, there has been a psychological impact on investors as Craig Alexander elaborates, “The immediate reaction by markets was negative, as they worried that the central banks actions signalled that there was a major problem. However, markets will eventually realise that the additional liquidity is extremely positive & supportive to the financial system.”

clarifies to B&E, “There are no rate cuts as we saw in 2001, so the liquidity expansion hasn’t been as broad based. Moreover, liquidity being injected is through overnight transactions, so the money does not remain in the system and it won’t be inflationary.” He further argues that if the credit problems persist, the central banks will cut rates, but this would hardly prove inflationary, since it will be in response to concerns of economic weakness. But then, what’s with equity markets, when everything’s been so prudent. Well, first of all, the sell off has been to an extent marked by banks reversing their equity positions in search of liquidity. Secondly, there has been a psychological impact on investors as Craig Alexander elaborates, “The immediate reaction by markets was negative, as they worried that the central banks actions signalled that there was a major problem. However, markets will eventually realise that the additional liquidity is extremely positive & supportive to the financial system.”Well, take a look around and one can see the markets are hitting back to normal and the trust seems to be back amongst the market participants. Well, a crisis of such debilitating proportion needed an divine intervention and… Christ they did act infallibly right!!!

For Complete IIPM Article, Click on IIPM Article

Source : IIPM Editorial, 2007

An IIPM and Professor Arindam Chaudhuri (Renowned Management Guru and Economist) Initiative

For More IIPM Info, Visit Below....

IIPM Mumbai Parables - Stories that change life

IIPM International Student Exchange Programme

IIPM, ADMISSIONS FOR NEW DELHI & GURGAON BRANCHES

IIPM, GURGAON

ARINDAM CHAUDHURI’S 4 REASONS WHY YOU SHOULD CHOOSE IIPM...

IIPM Economy Review

IIPM :- Cicero's Challenge is going global

The Indian Institute of Planning and Management (I...

Time for Awards at IIPM

No comments:

Post a Comment